MY 401(K)

Build Your Retirement Knowledge and Take Control of Your Financial Future

How We Can Help

We Provide Guidance On Rollovers

Choosing investments (target-date funds, index funds, bonds, etc.)

Understanding your employer match

Figuring out how much to contribute

Comparing traditional vs. Roth 401(k)

Rolling over an old 401(k)

Reducing fees

Planning withdrawals or retirement goals

We can help you develop a personalized retirement strategy, select appropriate investments based on your risk tolerance, and align your 401(k) with your overall financial goals.

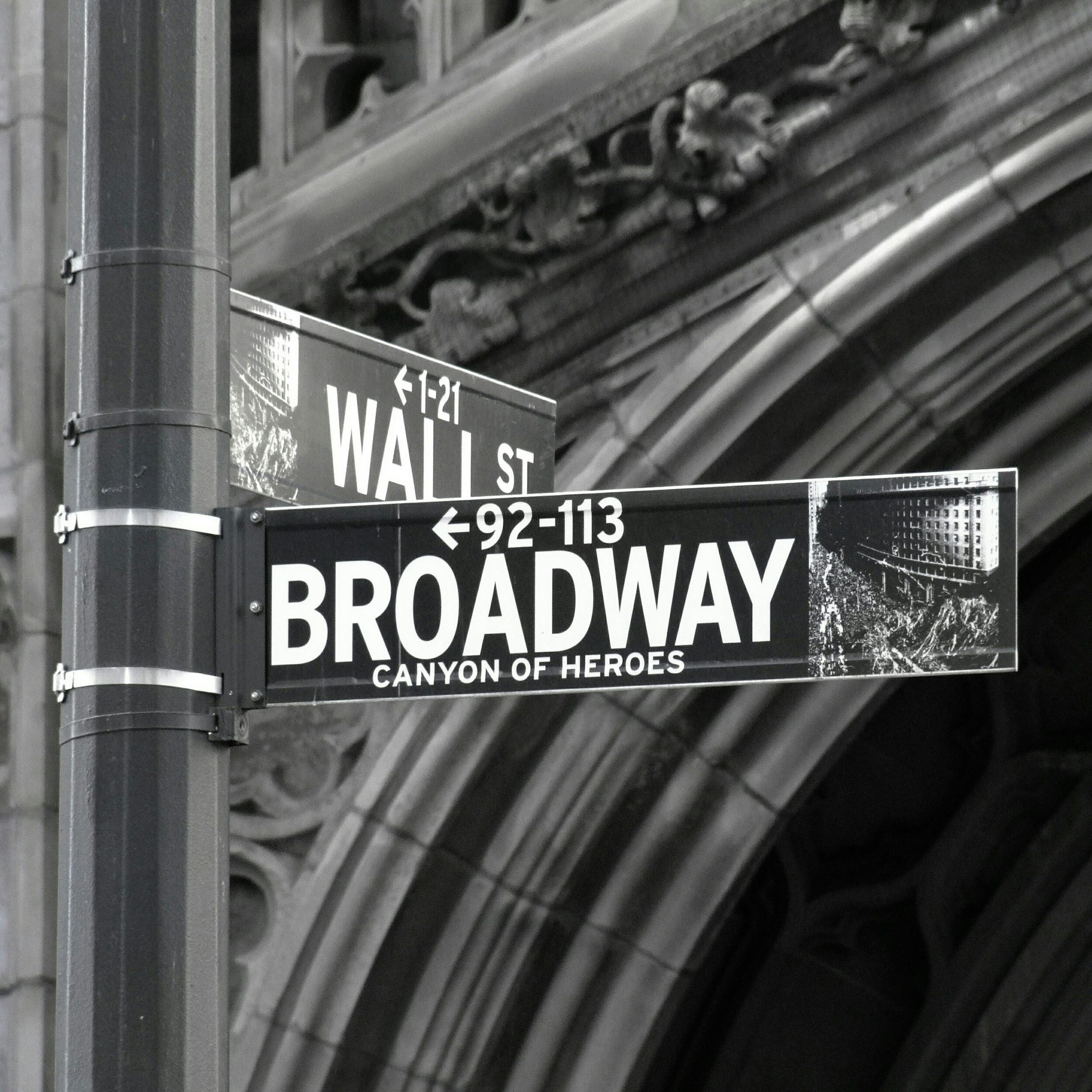

Why I left Wall Street

While on Wall Street, I gained extensive knowledge of financial markets, the economy, and human behavior. I honed my professional skills and learned how to manage risk effectively and confidently handle investor emotions. These skills remain invaluable to me to this day.

Grateful

It seems as though this worldwide pandemic has come at us so abruptly, smacking us in the face. Your natural reaction may be to strike back, instantly. Do something rash.

Confessions Of A Job Changer

I wasn’t switching industries but was looking for a firm that would better support my desire to provide a more holistic, planning approach to managing investors' portfolios.

It’s a Grind

Sometimes you may feel like you’re moving in slow motion, at a standstill, or even digressing. Unexpected expenses can trip you up.